tudor investment management | sam sullivan tudor tudor investment management The Tudor Group manages assets across fixed income, currency, equity and commodity asset . 1965 OMEGA SEAMASTER DE VILLE. SKU: OME910. $0.00. Out of Stock. PRODUCT INFO. Circa: 1965. Model: Seamaster De Ville. Caliber: 552. Movement serial #: 22504586. Jewel count: 24 jewels. Movement type: Automatic wind. Case model: 165.020. Case material: Solid stainless steel. Case gasket: Does not take a gasket. Crystal: Acyrlic new .

0 · who is paul tudor jones

1 · tudor investment holdings

2 · tudor investment corp website

3 · tudor investment corp et al

4 · tudor investment aum

5 · tudor asset management

6 · sam sullivan tudor

7 · paul tudor jones website

$26K+

who is paul tudor jones

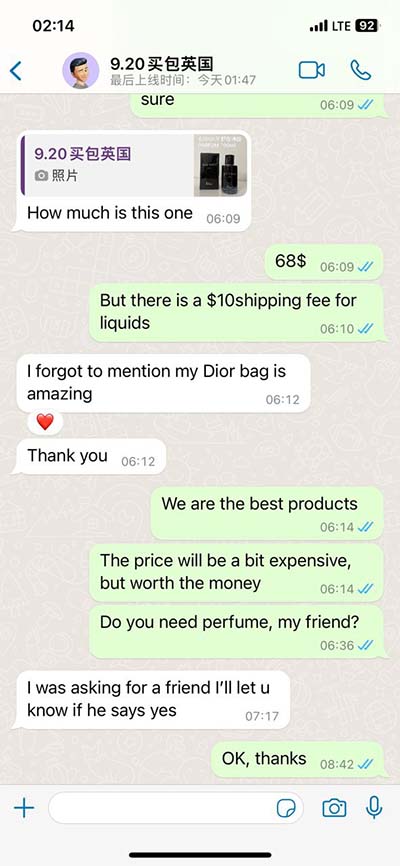

blue yellow dior b22

Tudor Group is a leading hedge fund manager founded by Paul Tudor Jones II in 1980. It offers .Under the menu, go to Desktops or Apps, click on Details next to your choice and .Learn about THE TUDOR GROUP, a global investment firm founded by Paul Tudor Jones II in .The Tudor Group manages assets across fixed income, currency, equity and commodity asset .

Tudor Investment Corporation is an American investment firm based in Stamford, Connecticut. The firm invests in both public and private markets globally.

Paul Tudor Jones II (born September 28, 1954) is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later, he founded the Robin Hood Foundation, which focuses on poverty reduction. As of July 2024, his ne.Tudor Investment Corporation, also known as TIC, is an investment management firm with .The Tudor group of companies ("Tudor Group") is a group of affiliated entities engaged in the management of client and proprietary assets. Paul Tudor Jones II formed Tudor Investment Corporation, the first of the Tudor Group companies, in 1980. The Tudor Group manages assets across fixed income, currency, equity and commodity asset classes and related derivative . In 1980, Jones founded the Tudor Investment Corporation, an investment management firm focused on the global markets. The company quickly expanded and now manages over billion in assets. Jones was also one of the first investors to recognize the potential of computer-driven trading and developed a computer-based system for futures trading.

Xantium Group is a division of the Tudor Group which includes Tudor Investment Corporation, Tudor Capital Europe LLP and other affiliated entities around the globe. . does not constitute an offer to or solicitation of any potential clients or investors for the provision by Xantium of investment management, advisory or other related services .

.92 trillion Assets Under Management (AUM) As of 7th August 2024, Tudor Investment Corp Et Al’s top holding is 465,562 shares of Spdr S&p 500 Etf Trust - Us Etp currently worth over 3 billion and making up 2.8% of the portfolio value. In addition, the fund holds 485,760 shares of Apple Inc - Us worth 2 billion.The third-largest holding is Bristol-myers Squibb Co - Us .How satisfied are employees working at Tudor Investment Corporation? 62% of Tudor Investment Corporation employees would recommend working there to a friend based on Glassdoor reviews. Employees also rated Tudor Investment Corporation 3.3 out of 5 for work life balance, 3.5 for culture and values and 3.3 for career opportunities.Tudor Investment Corporation (TIC) is founded in 1980 a Connecticut-based hedge fund manager, The Tudor Group is a group of affiliated entities engaged in the management of client and proprietary assets. Within the Tudor Group, TIC serves as the primary advisory entity. It manages assets across fixed income, currency, equity, and commodity .

tudor investment holdings

The assets under management (AUM) of Tudor Investment Corporation is .02 billion, all of which is managed in discretionary accounts. The firm's AUM has grown by 95% since the beginning of its operation, and .6 billion of the total AUM is .Tudor Investment Corporation, also known as TIC, is an investment management firm with more than billion in assets under management (AUM). It currently manages a total of 23 pooled investment vehicles, three of which are private equity funds and 11 of which are hedge funds.The firm currently employs 127 advisors.Tudor’s internship program is structured to provide interns with both a practical hands-on learning experience and exposure to the various functions within a diverse, global macro strategy alternative investment firm. As a Tudor summer intern, you will have a unique opportunity to work at an intersection of investment management, quantitative .The Tudor Group has a strong commitment to hiring individuals who welcome individual authority and accountability for results. If interested in applying for a position, please complete an application. Apply for this job * indicates a required field. First .

Tudor’s internship program is structured to provide interns with both a practical hands-on learning experience and exposure to the various functions within a diverse, global macro strategy alternative investment firm. As a Tudor summer intern, you will have a unique opportunity to work at an intersection of investment management, quantitative .

Tudor offers research-driven, professional investment management geared to client goals. The firm provides a rich history of investment management expertise (since 1992) with a laser sharp focus on quality investment income and growth securities. Our philosophy is based on a strong commitment to carefully chosen high-quality investment securities.The Tudor Group (“Tudor”) is a privately owned group of affiliated companies engaged in the investment management of client and proprietary assets. Paul Tudor Jones II formed Tudor Investment Corporation ("TIC"), the first of the Tudor Group companies, in 1980. Mr. Jones is the controlling principal and serves as Co-Chairman and Chief .

Experience: Graham Capital Management, L.P. Systematic Strategies - Tudor’s Systems Trading Group employs rigorous, applied research methods to test investment hypotheses and design quantitative computer-driven trading models across various investment horizons and global liquid asset classes.The information on this website does not constitute an offer to, or solicitation of, any potential clients or investors for the provision of investment management, advisory or any other related services.Under the menu, go to Desktops or Apps, click on Details next to your choice and then select Add to Favorites.

rdx.page_auto_refresh_off. Logoff is successful.

$9,750.00

tudor investment management|sam sullivan tudor